Avoid Surprises and Costly Mistakes Before Signing the Contract

Today, we’re joined by Greg Herskowitz, a seasoned real estate attorney, to discuss a critical topic: understanding new construction contracts in South Florida. Contracts for new construction projects often heavily favor the seller, granting them control over the terms, funds, and process. Many buyers enter the market without fully grasping the complexities, and some agents fail to offer adequate guidance. Without proper legal advice, buyers can face unexpected changes at closing, leaving them frustrated and disempowered. What you think you’re purchasing might not align with what you ultimately receive. This article breaks down essential contract clauses, provides strategies for navigating them, and offers practical tips to safeguard your interests in Miami’s competitive new construction market.

Process and Timeline

Purchasing a Miami new construction condo begins with reserving a unit or signing a contract. During this stage, buyers and developers negotiate key elements such as price, finishes, and materials. Once finalized, the purchase process unfolds with a typical payment schedule:

- Contract Signing: 20% of the purchase price is due.

- Construction Start: An additional 10–15% is required.

- Top-Off Phase: Another 10–15% is due when the building reaches its highest point.

- Closing: The remaining balance, often around 60%, is due at the end, usually a year or more after top-off.

By the time construction is complete, buyers typically pay about 40% of the purchase price, with the rest due at closing.

Understanding Delivery Timelines and Developer Reliability when buying a Miami New Construction Condo

Sales offices may promise a completion date of 2027, but contracts often include an “outside date” that can extend delivery to 2029 or even 2030. While new construction contracts typically set an estimated completion timeline of one to three years, they often allow developers an additional one to two years through this clause. These extensions are backed by terms, like a “force majeure” clause, that cover delays beyond the developer’s control—ranging from natural disasters to labor disputes, material shortages, or government-related delays. Without understanding these clauses, buyers may face unexpected, extended timelines outlined in the fine print.

Developers often build extra time into contracts for flexibility, so it’s crucial to understand the factors that drive their motivation to stay on schedule. Key elements like land ownership, financing, and timely groundbreaking all play a significant role. Developers who own the land outright and have strong financial backing are less impacted by interest rate fluctuations and are more likely to meet deadlines. On the other hand, those reliant on financing may experience delays if interest rates rise, as even minor increases can significantly affect construction costs.

Navigating these complexities requires an experienced agent. A knowledgeable agent can help identify reputable developers with solid track records, evaluate the reputations of architects and builders, and boost confidence in the project’s timeline and quality. Buyers can also negotiate terms like the “outside date” and include provisions for earlier delivery dates or penalties for delays, offering additional protection. Working with an agent who understands the Miami market and its key players is invaluable.

Financial Obligations

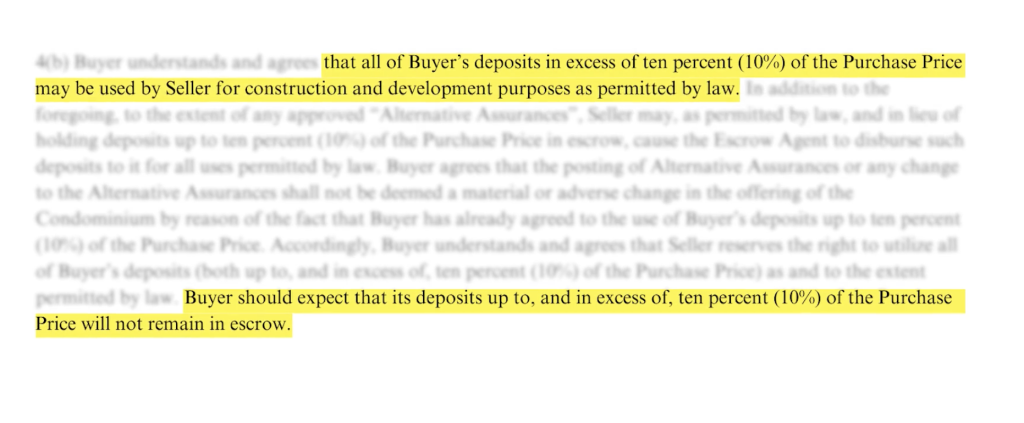

In Florida, developers can use up to 10% of buyer deposits for construction, unlike states such as New York where escrowed funds are protected. Buyers should confirm whether the developer has bond protections or other safeguards in place in case of defaults or delays. In some instances, you may be able to negotiate terms to recover your deposit if the developer fails to meet deadlines. To make the contract “hard” and satisfy lender requirements, developers typically request a 20% deposit. Lenders often require 50% of the units to be under contract before financing can begin. Buyers can inquire about cancellation options if this threshold isn’t met by a specific date. These terms may be negotiable, depending on the developer and the buyer’s leverage, such as the agent’s experience or connections.

Closing Process and Temporary Certificate of Occupancy (TCO)

A building closes once it receives a Temporary Certificate of Occupancy (TCO), which certifies that it is safe to live in, though not necessarily fully completed. The TCO indicates that the city has approved the building’s safety, but your unit may still have minor issues or unfinished details. The Certificate of Occupancy (CO), on the other hand, is issued when the building is entirely finished.

If specific amenities are crucial to you or you’ve purchased the property as an investment, it’s wise to include a clause in the contract requiring all amenities to be fully operational before closing. Developers’ willingness to honor such requests may vary, but we have successfully incorporated this protection for investors, such as those purchasing units for hotel programs who want to delay closing until the hotel is operational.

Some buyers prefer an early closing to secure benefits like selecting parking spaces, while investors may find it advantageous for simultaneous closings—where their unit closes and another buyer’s closing follows within 24 hours. These terms can often be negotiated with the developer.

It’s also worth noting that at closing, you’ll typically receive a credit rather than a price discount. Developers favor credits because offering discounts can impact overall property pricing.

Developer Fees and Closing Costs

The Developer Fee generally ranges between 1.25% and 1.7% of the sales price and is typically listed alongside the purchase price. At closing, you’ll also need to prepay HOA fees, which include one month’s HOA dues and two months’ capital contributions. These capital reserves are a newer requirement designed to ensure the building maintains a stable financial position and can handle emergencies.

The Developer Fee usually covers expenses such as owner’s title insurance, transfer taxes (doc stamps), and deed recording. Additional charges often include administrative fees imposed by the developer, which may be open to negotiation depending on the developer’s terms.

Expectations vs. Reality

When purchasing Miami new construction condo, it’s important to align your expectations with reality. Renderings often differ from the finished product, and changes to layouts or finishes can occur. After signing a contract, you have a 15-day cancellation period, including weekends. To maximize this time, we ensure the countdown begins only after you’ve received the condo documents. Carefully review these, as marketing floor plans can vary by 10-15% from the recorded square footage, and unexpected modifications, like added columns, may arise. We also make sure developers inform you of any major alterations.

Beyond the contract, conduct thorough due diligence. Investigate surrounding properties for potential view obstructions, and use tools like drones to confirm sightlines. Many agents overlook these details, but they’re critical for long-term satisfaction. Before closing, schedule a walkthrough with an inspector to compile a “punch list” of items for the developer to address. While developers usually cooperate, they’re not obligated to fix everything promptly. To ensure timely resolutions, we often include specific timelines in the contract. Once these issues are resolved, future maintenance becomes your responsibility, making thorough inspections essential.

Watch out for material substitutions, such as marble being replaced with porcelain. Request a detailed list of materials to hold developers accountable. Additionally, verify the building’s operating costs and HOA fees. Although initial estimates may change, confirming their accuracy can help prevent unwelcome surprises after closing.

Conclusion

When purchasing a Miami New Construction condo, it’s essential to understand the risks and safeguards involved. These contracts can be complex, and many mistakes arise from overlooking critical details like how deposits are used or developer timelines. Partner with someone who can distinguish between a smart investment and a potential pitfall—someone with direct connections to developers (not just their sales teams) and a keen eye for evaluating contracts and properties.

Choose an agent experienced in navigating these transactions, working alongside skilled attorneys to safeguard your interests. Pre-construction deals often involve unexpected changes, so it’s vital not to assume they are straightforward. Without proper guidance, you may arrive at closing to find discrepancies in square footage, missing amenities, or other deviations from what was promised.

While some agents merely accompany buyers to sales centers and relay marketing pitches, a knowledgeable agent will dig deeper—asking the right questions and conducting thorough due diligence. With the right support, you can avoid surprises and confidently make your investment.

Schedule a Meeting with David Siddons

If you are looking to buy a Miami New Construction Condo, please use an experienced. realtor and a real estate attorney. You can call me at 305.508.0899 for more information or schedule a meeting below.